Welcome to DealMakers where we join the dots in events M&A . We look at this month’s transactions and 2025 trends – and it’s mainly about the US.

Easyfairs buys in US

When Easyfairs, of Belgium, sold 60% of its shares to Inflexion and Cobepa in mid-2024 (at an estimated enterprise value of €680mn), two aspirations stood out. It wanted to increase the pace and scale of its acquisitions and it wanted to expand into the US – a market which was, at that point, unexplored territory for them. I’ll talk a bit more about the acceleration of M&A activity in my 2025 round up below. But here are three important milestones in Easyfairs plans for the US

- Having acquired Coiltech, the coil winding exhibition held in Italy and Germany, it launched the event in the US in Novi, Michigan, in June 2025. This has been described as the biggest launch in Easyfair’s history.

- It appointed Douglas Emslie as a board director, and Arnaud Istas as Group Head of M&A for the US.

- Now, it has made its first US acquisition – acquiring EPC (Energy Projects Conference & Expo) from UK entrepreneur Josh Bull (ex Reuters).

Held in Houston, EPC started out life in 2023 as an event initially targeting the liquified natural gas (LNG) sector and has experienced fast growth, doubling in size each year. It has expanded to serve the wider energy projects industry and now holds five simultaneous conferences covering engineering and construction projects in LNG export, power generation, petrochem & refining, midstream and alternative energies. It marks Easyfairs’ entry into the energy sector.

Hyve invests further in US healthcare

Following its recent acquisitions of HLTH and Behavioral Health Tech, Hyve Group, of the UK, has invested further in the healthcare sector acquiring U.S based HGAN (Health Grown Advisory Network) from founder Josh Riff. In recent years, Hyve has moved away from the standard trade show model, focusing on businesses that have a high level of executive interaction and introducing the 1-2-1 meetings format at many events.

The acquisition of HGAN takes this strategy one stage further as a business linking healthcare firms with senior executives, health‑plan and employer‑benefits decision‑makers to help with positioning, pricing, adoption, and scaling. There are synergies with Hyve’s other healthcare events as many of HGAN’s customers already attend HLTH, ViVE and Behavioral Health Tech and it also augments its year-round engagement strategy.

A rare acquisition in Canada

We don’t often see Canadian acquisitions but SiteNews has acquired Actual Media to create what they are calling Canada’s largest B2B media company, which will go under the name of SiteMedia. The construction industry SiteNews was founded in 2022 by marketing agency SitePartners. Actual Media organises ReNew Canada, Water Canada, Waste & Recycling and Hazmat, and the combined business will host more than 25 events. It is a Canadian business now but, like Easyfairs and Hyve, it too is eying the US market.

Summary of 2025

These three acquisitions bring total deal activity for 2025 so far to 62 transactions (34 different buyers) compared with 63 transactions (42 buyers) in 2024. Last year’s number was the highest post-Covid. We understand that most of the acquisitive organisers won’t be announcing any more transactions in 2025 (although several are working on deals for Q1 next year). The exception to this may be Nineteen Group (see this week’s Flashes & Flames reporting). Nineteen hired Mary Larkin (ex Diversified and Arc) as president of Nineteen Group Americas earlier this year who was joined by Justin Childs as COO, signalling big plans for the US.

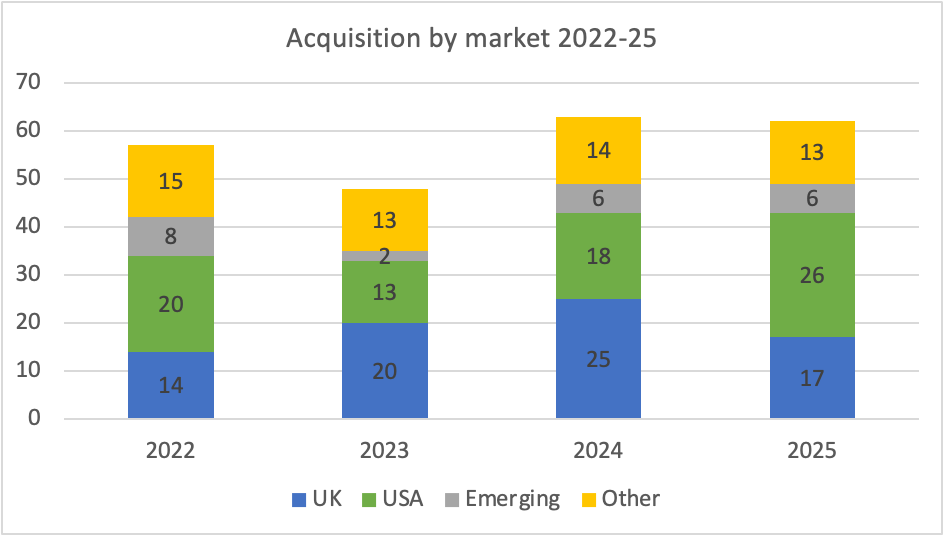

The general focus on the US has been consistent throughout the year. If we look at the geographical analysis for the transactions so far this year, compared with previous years, we can see the shift from the UK to US and it’s predominantly driven by UK-based organisers acquiring US events – some of which are operated by US organisers but others (such as EPC, above) organised by UK-based organisers.

Which organisers have been driving M&A in 2025?

The five most acquisitive organisers in 2025 are all private equity-owned. We are counting Emerald as PE owned (even though they are quoted on the New York Stock Exchange). Onex, its PE owner before it was listed) still owns 91.6% of the shares.

Emerald – Five acquisitions – three across US & Canada and two in the UK (This is Beyond and Insurtech Insights)

CloserStill Media – Five acquisitions including three in the US (AI4, Billington Cyber Security and PARCEL Forum). They have slowed down (or stopped?) acquisitions since September – perhaps a sign that owner Providence is preparing to exit in 2026.

Easyfairs – Five acquisitions spread across the UK (Chem UK and Digital Accountancy Show), Sweden, Switzerland and US (EPC).

Hyve – Four acquisitions – all in the US (Manifest, Behavioural Health Tech, GSV Summit and HGAN)

Nineteen Group – Four acquisitions including three in the UK (Payments Association, Commercial Vehicles Show and National Painting and Decorating Show). The UK company could double this number of deals before the year-end (see separate story in this week’s Flashes & Flames).

Of the world’s three largest organisers, only Informa has been active, acquiring Art Monte Carlo and Hyve’s India portfolio.

Potential trends for 2026

Entrepreneurs which have made money developing and selling their own businesses are now backing the next generation of entrepreneurs. Events Venture Group invested in 3 businesses in 2025 (Deep Tech Momentum, Stablecon and Explori), Manta Media Capital, set up by Toby Duckworth (ex 121 Partners) with Douglas Emslie investing alongside, will debut in 2026 offering both finance and management to event startups while Charlie Kerr plans to invest some of the money from the recent sale of With Intelligence in taking minority shareholdings in post-startup B2B companies which can become the providers of “bibles” in markets across the world, as reported last week by Flashes & Flames.

Will the groundbreaking Raccoon Media JV with Messe Munich for ISPO be the start of a new era of co-operation between UK and German organisers? tfconnect and Germany-based research company Schmitt & Jaehnke Partners seem to think so with their development of an Anglo-German organiser summit.