Welcome to the exclusive Dealmakers column which will be published in Flashes & Flames on the first Friday each month. Today’s northern Summer catchup details 13 transactions, dominated by activity in the US. And we’ve got an update on the global rankings of trade show organisers. The top two have stayed in position – but there’s plenty of movement further down the table and some really impressive growth.

Let’s start with the latest big deal: Northstar Travel Group, the travel media group whose brands includes Travel Weekly, Americas Lodging Investment Summit and The Meeting Show, is to be sold to JTB, a Japanese travel solutions provider. Current owners PE firm EagleTree Capital acquired Northstar from Wicks Group in 2016 and, under their ownership, Northstar has made several acquisitions including CAT Media and Buying Business Travel in the UK and generates revenue of around $130m. Last week Flashes & Flames suggested that the purchase price is in the region of $350mn.

What makes this transaction particularly interesting is the buyer. Normally when a pe owner exits, they sell either to another pe firm or, occasionally, to an existing organiser (for example, Charterhouse selling Tarsus to Informa). By contrast, JTB is an international travel agency with revenues of $7.3bn and an operating profit of around $100mn – a margin of only 1.3%, a mere fraction of those achieved by exhibition organisers.

JTB intends to allow Northstar to run independently, so why have they acquired it? The stated rationale is that it advances JTB’s growth strategy, which includes geographic expansion and targeted investments in events, information services, market intelligence and other strategic lines of business associated with the travel industry. It will be interesting to see how they manage Northstar and, perhaps, what comes next.

Two bolt-on deals for Hyve

Hyve Group continued its US acquisition drive with the purchase of Behavioral Health Tech (BHT) to complement HLTH which they acquired in October last year. BHT is dedicated to expanding access to behavioral healthcare—including mental health, substance use, and autism/intellectual/developmental disabilities (IDD) services—through the power of technology, health equity, and innovation. It was launched by Solome Tibebu in 2020 as a virtual-only event, designed to bring together leaders, innovators, and policymakers in behavioral health technology. The now in-person event grew to over 2,000 delegates in 2024.

Hyve followed this with the acquisition of GSV Summit LLC whose portfolio consists of the ASU+GSV Summit and the AI Show. The business began in 2010 as a partnership between Arizona State University (ASU) and Global Silicon Valley (GSV), with the goal of bringing together leaders from education, technology, business, policy, and investment to drive innovation in learning and workforce development. Since then, it has grown into one of the world’s largest and most influential edtech and workforce innovation conferences, held annually in San Diego. The AI Show was launched in 2024 bringing together educators, innovators, and AI explorers to shape the next chapter of AI in education. The two events are held on overlapping dates creating a week of innovation in education and will slot into Hyve’s education portfolio alongside BETT.

Together with HLTH, Manifest (logistics) and POSSIBLE (marketing), this means Hyve has made five acquisitions in the last 12 months. It is just over two years since the former UK listed Hyve was acquired by pe firms for an enterprise value of £400mn, some 2x revenue.

Emerald spends $220mn on 2025 deals

Emerald, of the US, has acquired Canadian organiser Generis Group for $60mn. Generis was founded in 2014 and organises B2B executive summits in the US and Europe across the supply chain, manufacturing, packaging, digital transformation, and life sciences sectors. These include the American Manufacturing and Biomanufacturing Summits and the American Automotive Summit. The 17 events held across the USA and Europe increase the total number of Emerald executive summits owned to more than 50. Earlier this year, it acquired the This is Beyond portfolio of luxury travel shows, Insurtech Insights and Plant Based World Expo. Total acquisition spend this year so far is $220mn.

Events Venture Group makes its second and third investments – and they’re both tech again

US-based Events Venture Group (EVG), is a collective consisting of more than 35 founders, serial entrepreneurs, and top-tier event operators including: Greg Topalian (chair, Clarion Events North America), Marco Giberti (founder, of Vesuvio Ventures), Jonathan Weiner (founder, HLTH), Jay Weintraub (founder, Connectiv), Douglas Emslie (former CEO, Tarsus) and Kerry Gumas (CEO, Metacomet).

EVG was formed in May 2024 and made its first investment in November last year, backing the US-based Quantum World Congress.

Since its inception, EVG claims to have reviewed more than 130 opportunities and some 50 since that first investment. They have just announced their next two investments. The first is in German company Deep Tech Momentum (DTM), a leading European deep tech event platform. DTM was launched by Dr Martin Schilling and Isabelle Flanagan and has built a digital platform which connects leading European enterprises with deep tech startups and runs a leading European Deep Tech summit whose 4th edition was held in Berlin in May.

The other investment is an interesting one in that it is an event tech enabler rather than an exhibition business. Explori was launched in 2012 by Mark Brewster with the aim of providing a data-driven, standardised event measurement system. Over the years, they have worked with many of the leading organisers. In 2023, they launched Maxbi – a resource for event marketers to make informed decisions about strategy and spend to drive the success of their exhibit programs. All of their products feed into helping exhibitors maximise RoI.

A quick trip around the world with acquisitions and partnerships

| Buyer | |

| Ninteen Group, UK | The Payments Association (UK) |

| Nineteen acquires the membership organisation for the payments industry and organiser of the annual PAY360 exhibition and conference. | |

| Turnmill, UK | iGlobal Forum (USA) |

| Horizon Capital-owned Turnmill makes its fourth acquisition – a series of high-level events in private capital markets. | |

| Arc, UK | Touchpoint Markets (US) |

| The ninth acquisition for four-year-old, pe-owned Arc (bigger now in the US than the UK) is a portfolio of brands in financial services and HR, including: ThinkAdvisor, BenefitsPRO, PropertyCasualty360, GlobeSt, and Credit Union Times. Good fit with Arc’s UK-based Incisive Media. | |

| Fiera Milano and IEG, Italy | EMAC S.r.L (Italy) |

| Fiera Milano and Italian Exhibition Group each acquire 35% of classic car show organiser running Milano AutoClassica (launched in 2012) and the Vicenza Classic Car Show (launched 2024). | |

| RX Global, UK | Bhiraj Buri Group (Thailand) |

| RX creates a JV with the owner of the Bangkok International Trade and Exhibition Centre (BITEC) and launches RX BITEC. | |

| Informa, UK. | Art Monte-Carlo (Monaco) |

| Informa adds the nine year old contemporary art fair to the Informa Prestige luxury and lifestyle portfolio which includes Monaco Yacht Show and Top Marques Monaco | |

| Terrapinn, Australia/UK | Digital Health Festival (Australia) |

| Hamish Steel scales and sells his first events business and now it’s off to university. Tony Steel and Greg Hitchen’s Terrapinn acquires the leading digital health event after it’s fourth edition, keeping it in the family. | |

This brings to 39 the total number of transactions so far this year, compared with 32 at the same time last year. It’s interesting that the fears of how M&A would play-out with the US administration’s trade policies have seem unfounded. There is much to look forward to, including the presumed resolution of the Clarion Events sale process and how its Global Sources business in Hong Kong will be handled, and potential exits – presumably in 2026 – for the Providence investments in both Hyve Group and CloserStill Media, two of the fastest growing trade show organisers. The rise of the privately-owned Terrapin (charted by Flashes & Flames over the past few years) poses some obvious questions about what’s next?

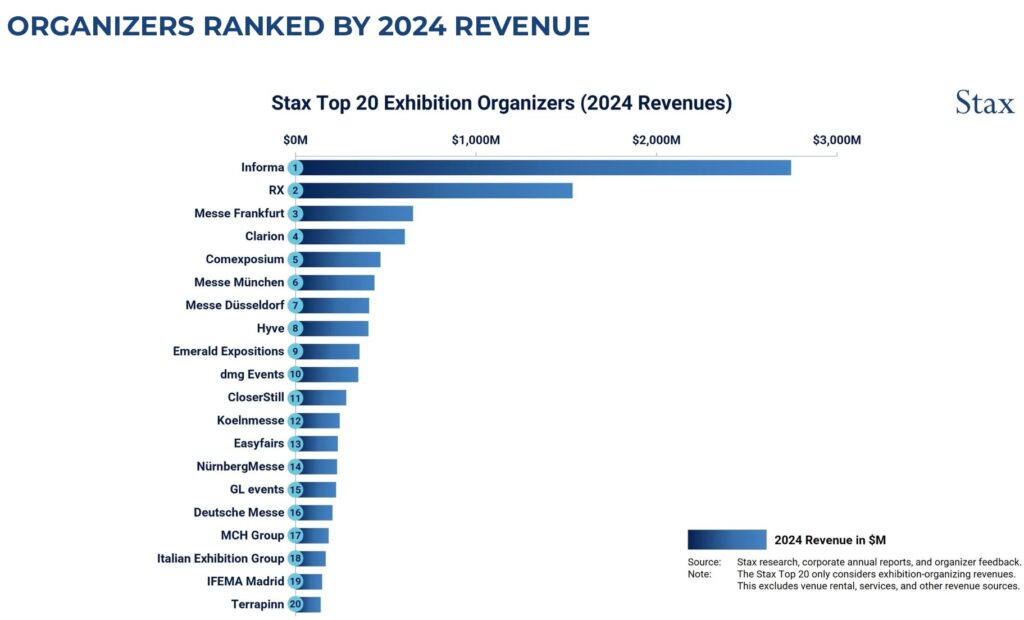

The global exhibition industry is transforming, according to the latest figures from Stax. Aggregate revenue across the Top 20 organizers rose from $8.77bn in 2023 to just over $10bn in 2024, a 14% annual increase. It is now 20% higher than the pre-Covid peak of 2019. This demonstrates both the completeness of the recovery (as already evidenced by many company financials) and the unmistakeable reshaping of the industry’s competitive hierarchy.

Key takeaways:

- Informa remains in the top spot, reaching a record-breaking $2.74bn in revenues (including the acquisition of Ascential), followed by RX

- Messe Frankfurt is third, displacing Clarion

- Hyve and DMG Events entered the Top 10 after extraordinary growth—Hyve nearly doubling revenues through acquisitions such as HLTH and POSSIBLE, and DMG growing ~70% with strong momentum in energy and infrastructure.

- CloserStill, NürnbergMesse, and Easyfairs all rose in the rankings, while IEG, IFEMA, and Terrapinn joined the Top 20 for the first time.

Stax says: “These shifts highlight the evolving dynamics between institutional organizers, tied more closely to fixed venues, and non-institutional organizers, whose growth has been powered by international expansion, acquisitive strategies, and sector-focused models.”

Steve Monnington is CEO of Mayfield Merger Strategies