Heroes

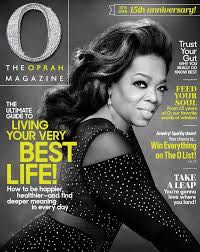

Oprah Winfrey: It is 15 years since Oprah Winfrey chose to channel her motivational “you-can-do-it” spirit into a glossy monthly, in a joint venture with Hearst. Within months, “O, The Oprah Magazine” was out-selling top American women’s titles, with a circulation of more than 2m. In its first year, it was voted US Magazine of the Year and Best Launch of the Year. It was as hot as Oprah herself – and, in many ways, it still is.

The magazine exhorts “confident, intelligent women to reach for their dreams”. With lush photography and oversize pages, each issue offers compelling stories and empowering ideas stamped with Oprah’s vision of making the most of life. The Oprah Magazine is like a beautiful gift book its readers can’t throw away. The 15th anniversary issue, which hits newsstands this week, includes 15 chapters or mini-sections that play on Winfrey’s mantras, including “It’s Never Too Late,” which explores the career changes of successful women.

Hearst notes that the magazine has pulled in $1bn of revenue in its first 15 years but there have been bumps along the way. When Oprah’s top-rated talk show came off the air in 2011, newsstand sales dropped 20%. In 2014, they totalled 298,980 – down 50% since 2010 – and total circulation has slid 3% to 2.4m. But it is still a substantial force, and may represent the kind of branded media we will see more of as magazine-media develops its post-digital identity.

The magazine is very much Oprah. She has featured on every cover, and it was a full nine years before she even shared the billing – with US President’s wife Michelle Obama.

But the success also owes a lot to Hearst Corporation. What is, arguably, the world’s oldest and most successful multi-media company, is built on joint ventures, partnerships and strategic alliances. Today, it has major deals with Disney, MGM, Rodale, BuzzFeed, Stylus, Roku and a long list of the world’s leading magazine groups. The enduring success of many of these ventures reflects the Hearst enthusiasm for long-term partnerships. The founder William Randolph Hearst (Citizen Kane himself) was easy to characterise as selfish and ruthless. But the company has prospered in the 64 years since his death by being – well – unselfish, collegiate and collaborative. Oprah Winfrey, who can have her moments of diva-dom, knows just how good that is for business.

Context: Is the world’s first media company now the best?

Andrew Rashbass: Euromoney Institutional Investor Plc (“Euromoney”), the £1.5bn UK-based information and events company, last week named former CEO of The Economist Andrew Rashbass, as its new executive chairman, scarcely 18 months after he had been appointed CEO of Reuters. The appointment is intriguing because Euromoney is a distinctive company, for at least three reasons:

First, it is 68% owned by DMGT (the UK’s Daily Mail group), the family-controlled but stock market-listed group which is now 80% dependent on B2B media. And 33% of all DMGT profits come from Euromoney, which was launched 36 years ago by a former Daily Mail financial journalist. Euromoney was floated on the London stock exchange in 1990 and has been the role model for DMGT’s successful ‘light touch’ management of its investments in subsidiaries and associated companies.

Second, Euromoney has consistently been one of the best-performing European B2B companies and has increased profits almost three times in the past 16 years. Last year’s pre-tax profit of £87m (on revenues of £407m) was the first dip for more than five years, due to decline in the company’s financial training division. But a bounce-back is forecast in 2015.

Third, it has long been distinguished by extraordinarily generous board remuneration. Euromoney executive directors benefit from a no-ceiling profit share scheme which last year paid out £7.2m or 8.3% of pre-tax profit – equivalent to almost five times the directors’ total salaries. A cool £4.4m of this payout went to outgoing executive chairman Richard Ensor, whose total remuneration was £4.6m. That must be some comfort to Andrew Rashbass who received $3.8m for his first eight months at Reuters. Ensor has, for the past two years, received more than twice the remuneration of Martin Morgan, CEO of the high-performing parent company DMGT whose revenue is almost five times that of Euromoney. Morgan has been principally responsible for DMGT’s impressive B2B profit growth over the past 25 years.

Analysts will be closely watching these remuneration policies because we should expect Andrew Rashbass (who was formerly with DMGT’s Associated Newspapers) to succeed Morgan in the next year or two. Which might explain his quick-fire defection from Reuters.

Context: Will UK’s last press baron ditch newspapers?

Villain

Jann Wenner: These are (or should be) humbling times for the founder and owner of Rolling Stone, the 48-year-old, one-time underground magazine. It is four months since his managing editor Will Dana apologized for the November 2014 story “A Rape on Campus” about an alleged gang rape at a fraternity party in the University of Virginia. Inquiries by The Washington Post and others had quickly revealed major errors and discrepancies in the magazine’s report, and called for dismissal of the reporters concerned. Rolling Stone subsequently issued three apologies, and commissioned its own investigation from the Dean of the Columbia School of Journalism.

The Columbia report uncovered what was described as “complete journalistic failure and institutional problems” with reporting at Rolling Stone. It said the fortnightly magazine had ignored fact-checkers’ warnings that the alleged rape victim was the article’s only source for important details, calling it the fault of the reporter, editor, the editor’s supervisor and the fact-checking department. It basically found mistakes and mismanagement throughout Rolling Stone, all the way up to the managing editor.

But Wenner managed to read something else altogether into the damning criticism. In an interview with the New York Times, he heaped all the blame on the alleged victim as “a really expert fabulist storyteller” who managed to manipulate the magazine’s journalistic processes. He is further reported to have said that the reporters were so corrupt as to steamroll the editor, who was too weak to resist.

Jon Stewart, TV host of The Daily Show and a natural supporter of Rolling Stone, was incensed. He told Wenner that the Columbia report was “a list of things that, in many circumstances, people would be punished for. This isn’t a gaffe or a brain fart or a whoopsie daisy. This is a big deal. And you can’t just deal with it by issuing a correction. This story is monumental f*ck-up territory.”

It is difficult to believe that the upshot of this shocking episode will be anything less than some very expensive legal claims and the permanent loss of journalistic and commercial credibility for a magazine with a distinguished history. This could be very damaging indeed for Wenner Media (publisher also of US Weekly and Men’s Journal) which is facing challenging financial times. It feels dangerous. And it comes just 20 months after a celebrity-like Rolling Stone cover of the alleged Boston Marathon bomber was accused of “glamorizing terrorism”. Wenner’s people responded that the cover “falls within the traditions of journalism and Rolling Stone’s long-standing commitment to serious and thoughtful coverage of the most important political and cultural issues of our day.” No such defence has even been attempted this time.

Presumably, there’s still time for Jann Wenner to limit the damage. But not much.